do you pay taxes on social security

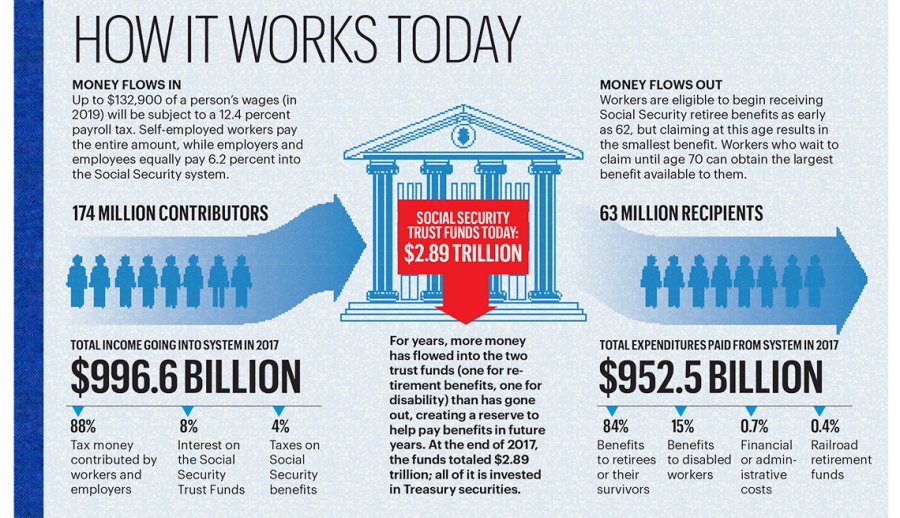

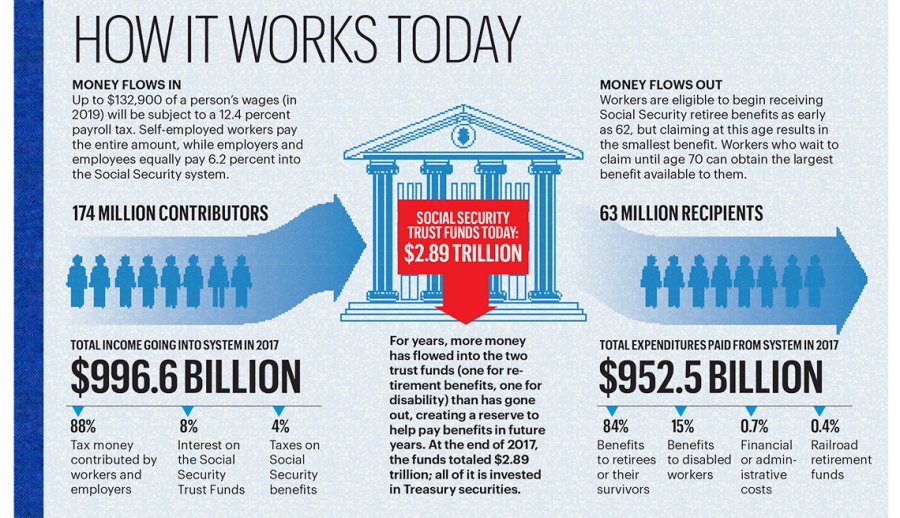

Social Security benefits include monthly retirement survivor and disability benefits. You may need to pay income tax but you do not pay Social Security taxes.

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

You pay social security contributions based on your income up to a certain amount.

. If your income is higher up to 85 of your benefits may be taxable. What taxes are payroll taxes. The SSA factors in bonuses commissions and vacation pay.

Half of it is taxable if your income is in the 2500034000 range. Currently there are 37 states in the US. You would pay taxes on 85 percent of your 18000 in annual benefits or 15300.

Federal income Social Security Medicare and federal unemployment. That do not tax Social Security benefits. Nobody pays taxes on more than 85 percent of their Social Security benefits no matter their income.

In general though if. Learn How Much You Will Get When You Can Get It and More With the AARPs Resource Center. You pay Medicare taxes on all of your self-employment wages or net income.

Thats 1 for every 3 you earned over the limit. 17 hours agoYour Social Security benefits would be reduced through July by 226. Your Social Security benefits are taxed as ordinary income.

Keep in mind that for most people you. Some people who get Social Security must pay federal income taxes on their benefits. Employees must pay Social Security and Medicare taxes through payroll deductions and most employers also deduct federal income tax payments.

They dont include supplemental security income payments which arent taxable. Social Security income is generally taxable at the federal level. If the bill becomes law the tax exemption on Social Security income would take effect in the current tax year.

There are four basic types of payroll taxes. Get Your Max Refund Today. If you are filing as an individual your Social Security is not taxable only if your total income for the year is less than 25000.

Fast And Simple Tax Filing. At what age is Social Security no longer taxed. File a federal tax return as an individual and your combined income is between 25000 and 34000 you may have to pay income tax.

For higher earners it depends on whether youve reached the Social Security Tax cap or have to pay the Additional Medicare Tax. If youre above the income cap you pay 124 on income up to the cap and then 0 on the rest of your income. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

Do you pay Medicare tax on Social Security income. The IRS taxes only 50 to 85 of your benefits. 3 rows The simplest answer is yes.

AARP Is Here to Help. Get Your Income Taxes Done Right Anytime From Anywhere. Half is taxable if your income is between 25000 and 34000.

The bill caps the exemption at 75000 for married couples filing separately 150000 for married couples filing jointly and 100000 for individuals which means New Mexico would. If youre married that threshold increases slightly to. The portion of benefits that are taxable depends on the taxpayers income and filing.

If you file a joint return you must pay taxes if you and. Having a larger retirement income is great. When your income exceeds 34000 44000 for couples you may need to pay income tax on as much as 85 of your Social Security income.

If you file as an individual your Social Security is not taxable only if your total income for the year is below 25000. It would be adjusted beginning in August 2022 when you reach full retirement age you would receive your full benefit 800 per month no matter how much you earn. Pennsylvania does not tax social security and does NOT tax most types of retirement income as long as you retired AFTER meeting the eligibility requirements for separation from service by retirement based on old age infirmity long-continued service or a combination of old age and infirmity and long continued years of servicePA Retirement.

Generally No. Social Security is taxed at the federal level but may or may not be taxed at the state level. It wouldnt be available to everyone however.

Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. The Internal Revenue Service IRS requires that you pay taxes on some of those benefits if your IRA or 401 k withdrawals increase your overall combined income past a certain limit. The Social Security Administration estimates that about 56 percent of Social Security recipients owe income taxes on their benefits.

These taxes are for Medicare coverage. Having a larger tax-free retirement income is even better. You must pay taxes on your benefits if you file a federal tax return as an individual and your combined income exceeds 25000.

There are no special tax rates for Social Security like capital gains rates for investment income. However no one pays taxes on more than 85 percent of their Social Security benefits. The Social Security Tax rate is 124.

If youre single once that total reaches 25000 youll face taxes on some of your Social Security benefits. Even if you have to pay taxes on your Social Security you wont pay them on the full amount. 23 hours agoYou can use Worksheet 1 in IRS Publication 915 to figure out exactly how much youll pay in taxes on your Social Security benefits.

Ad Need Help Understanding Your Social Security Benefits. FAQs qnadmin December 21 2021. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules.

In 2021 this amount will be 142800. At 65 to 67 depending on the year of your birth you are at full retirement age and can get full Social Security retirement benefits tax-free.

13 States That Tax Social Security Benefits Tax Foundation

12 Facts About How Social Security Works

/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About Fica Social Security And Medicare Taxes

Taxes And Your Social Security Benefits

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

0 Response to "do you pay taxes on social security"

Post a Comment